Starting your own investment fund?

If so, how are you assembling your team? Is it folks you know from your previous job? Are you going through a matchmaking process?

One of the key factors that can make or break your fund's success is the team you choose. Here’s what LPs look for in a purposefully built team for your debut fund.

Mission Alignment among Founders

Before diving into the details of assembling your team, it's crucial to establish a shared vision and mission. This alignment often comes through a process of trial and error. Founders should work together, learn from their failures, and gradually shape the organization's vision.

In our LP Lens webinar series, Sheryl Mejia, Managing Partner, Steward Asset Management and Agata Rzamek Praczuk, Director, Emerging Managers Program, MetLife Investment Management share their insights on how debut fund managers should approach building the founding team.

Identify Subject Matter Experts

While founding team members are essential, your team should also include subject matter experts who bring unique skills and insights to the table.

These experts may not necessarily hold the title of a general or founding partner but can add immense value to your fund. Look for individuals who have retired from executive roles but are still eager to contribute their knowledge and experience to your venture.

Team Dynamics Matter

Team dynamics play a crucial role in the success of your fund. According to our expert, trying to figure out team dynamics while launching a fund can lead to failures. It's essential to have some years of working together under your belt to ensure a well-functioning team.

Consider the skills and expertise you need in your team. Think about the scientific, technical, and operational knowledge required to manage your fund effectively. This includes sourcing value-add opportunities and managing exits.

Don’t Lose Focus on Building Initial Operations

Building the initial operations of your fund is a crucial step. It requires putting in place policies, legal frameworks, and other foundational elements. Our expert emphasizes that this initial effort is often more extensive than the ongoing operating needs of the fund.

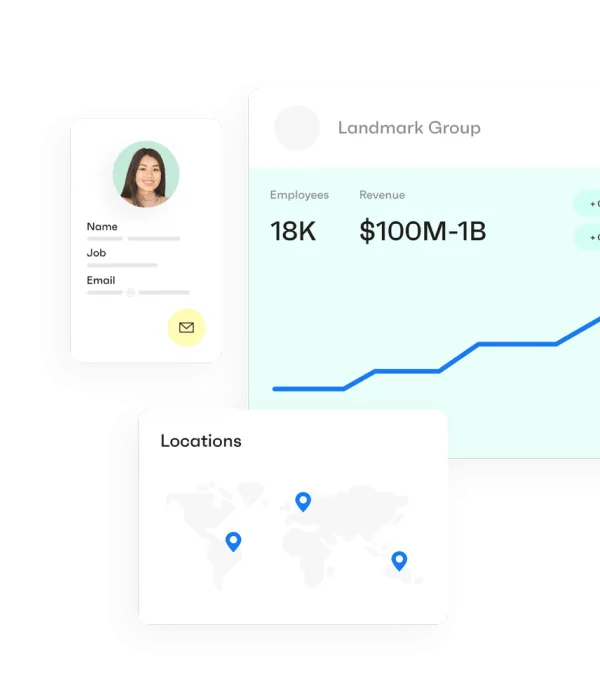

Grata Helps Emerging Fund Managers Build their Deal Sourcing Pipeline

Building a successful startup fund requires careful consideration of your team's composition, mission alignment, and expertise. Seek out subject matter experts and sponsors who can contribute to your fund's growth and success. By following these insights from our experts, you'll be better equipped to embark on your journey of launching and growing your own fund.

Grata helps play a part in the deal sourcing transparency and differentiation. LPs want to know what sets you apart and how you plan to find the deals that no other GP can.

Grata is the leading deal sourcing platform that helps dealmakers find, research, and engage with middle market companies. Set up a demo to learn more.